The Annual Information Statement (AIS) is a comprehensive overview of taxpayer information, presented in Form 26AS. It allows taxpayers to provide feedback on the information displayed. The AIS displays both the reported value (as provided by reporting entities) and the modified value (after taking into account taxpayer feedback) for each section, such as TDS, SFT, and other relevant information.

Previously, Form 26AS served as a consolidated annual tax statement, encompassing details of any TDS deductions made on your behalf, as well as records of Advance Tax or Self Assessment Tax payments, and high-value transactions you may have conducted.

The Annual Information Statement (AIS) goes beyond Form 26AS and includes additional information like interest, dividends, securities transactions, mutual fund transactions, details of overseas remittances, as well as information on demands and refunds issued.

Starting from Assessment Year (AY) 2023-24, the Annual Tax Statement (Form 26AS) accessible on the TRACES portal will only present data related to Tax Deducted at Source (TDS) and Tax Collected at Source (TCS). Other information will now be provided in the Annual Information Statement (AIS) available on the e-filing portal. However, for data preceding AY 2023-24, there will be no alteration in the way it is displayed.

The Taxpayer Information Summary (TIS) is a concise statement that provides an aggregated summary of taxpayer information by category. It simplifies the process of submitting returns. Taxpayers have the option to download the AIS/TIS in PDF, JSON, and CSV formats.

Q How can I view the Annual Information Statement?

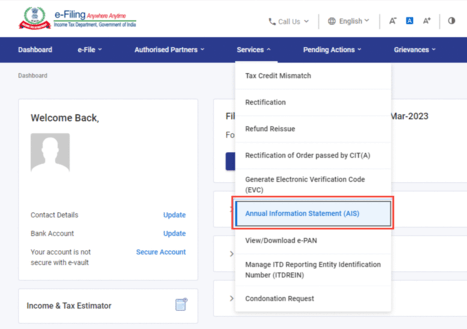

A To access the Annual Information Statement (AIS) functionality, please follow the steps below:

Step 1: Login at e-filing portal: https://www.incometax.gov.in/

Step 2: Click on “Annual Information Statement (AIS)” under “Services” tab from the e-filing portal after successful login on e-filing portal.

Step 3: Click on the ‘Proceed’ button.

Step 4: On the AIS homepage, click on the "AIS" tab.

Step 5: Select the appropriate Financial Year (FY) for which you wish to view the Annual Information Statement.

Step 6: Click on the AIS tile to access and view the Annual Information Statement.

Q In what all formats can I download my AIS?

A You can download Annual Information Statement (AIS) in PDF, JSON, CSV file formats.

Q What is the password to open AIS PDF?

A The AIS PDF file is password-protected. To open the AIS PDF, you need to enter the password in the following format:

For individual taxpayers:

For non-individual taxpayers:

For example, if the PAN is AAAAA1234A and the date of birth is 01st April 1999, the AIS password will be aaaaa1234a01041999.

Q What are the components of Annual Information Statement (AIS)?

A The components of the Annual Information Statement (AIS) can be divided into two parts: Part A and Part B.

PART A - General Information: Part-A displays general information, including PAN, Masked Aadhar Number, Name of the Taxpayer, Date of Birth/ Incorporation/ Formation, mobile number, e-mail address and address of Taxpayer.

PART B: The second part of the AIS consists of various components that provide specific information about the taxpayer's financial transactions. These components include:

These components collectively provide a comprehensive view of the taxpayer's financial information in the Annual Information Statement (AIS).

Read here to know what to do if there is an error in AIS or Form 26AS.